Budgeting can seem complicated, confusing, and overwhelming no matter how old you are. But when you are just starting out and don’t completely understand how finances work, the process can feel like too much to handle. Here are some simple steps from out partner, BALANCE, on how to get started.

Written by Josephine Redfern

Budgeting can seem complicated, confusing, and overwhelming no matter how old you are. But when you are just starting out and don’t completely understand how finances work, the process can feel like too much to handle. It’s incredibly important to track the money you’re spending and the money you’re receiving. The good news is, you don’t need to be an accountant or a financial manager to handle your own personal budget. As a college student myself, I’m still learning about how to handle my money, but I’d like to share with you some of the ways I’ve found are helpful for my personal budget!

Budgeting Basics

First, let’s talk about the basics of budgeting. The best way to break down your budget at first is to look at it from month to month. Before you start your budget, write down all your expenses you’re planning on making in the next month. There are two types of expenses: fixed and variable. A fixed expense is one that is the same amount every month and is usually paid around the same time. For example, your phone, student loan, and rent bills are all fixed expenses. Variable expenses, on the other hand, are expenses that change each month depending on your own personal wants and needs. These expenses include eating out, grocery shopping, or fixing your car. Writing down how much you are planning to spend on your fixed expenses, and how much you are aiming to spend on your variable expenses is important, especially when you are operating with less money during school. After calculating your expenses, calculate your income. Your income is how much money you are receiving throughout the month. This is from your employment, student loans, gifts, and any small investments you might have made. If your income is less than your calculated expenses, this is when some reevaluating needs to happen.

Monitoring Your Money

Monitoring your spending is all about keeping track of how much is coming into your bank account and how much is leaving. To do this you should be listing and categorizing each transaction that you make. For example, when you receive your paycheck, put the amount in an income column and when you buy something new put that amount in an expense column. This way you can see if your spending habits are not infringing on your savings! Here is a great online budget tracking spread sheet you can utilize https://www.mybalancebudget.org/!

You always want to make sure that you are saving more than you are spending, and that a portion of your income is being saved for emergencies. The standard amount you want to have in emergency savings is three to six months of your expected expenses. A good rule of thumb to follow is having three months of rent in an emergency savings account. Listing out your income and expenses like this is also a great way to watch where your money is going and if you could cut back. For me, I know that I spend way more than I budget on eating out and food. This is an area where I can cut back and monitor my spending a little more. When looking at ways you can cut back, take a look at this article https://uhmfoundation.balancepro.org/resources/newsletters/five-habits-that-can-ruin-your-budget

A great budgeting rule that can help you to monitor your money is the 50/30/20rule. Senator Elizabeth Warren popularized this rule in her book, “All Your Worth: The Ultimate Lifetime Money Plan”. This rule is super helpful for learning to budget effectively and consistently. The main idea is to take your monthly income (after taxes) and divide it between your needs, wants and savings. 50% of your income should gotowards your necessities or things that you cannot go without. 30% goes towards things that you want. These include travel, eating out and entertainment. The other 20% of your monthly income should go towards savings and debts. This could be your student loans and maybe even a future retirement fund! Another good rule to keep in mind is to never spend more than 30% of your income on housing and rent.

Creating Your Financial Goals

Creating financial goals is super helpful when budgeting throughout your life. Instead of just focusing on what you want right now you’re able to start thinking about your future and how saving your money will help with it. By creating financial goals and really putting thought into what you want in your life you’re able to look at the big picture of what having financial stability really means. Set short term goals for the next year or two of your life, or what you want to be saved up for within the next few months. This could be owning your own car or being able to afford your first apartment. Next, it’s good to set 5, 10, or even 20-year goals. Personally, my 10-year goal is to own my own home. These vary from person to person, so it’s important to recognize your priorities and what you imagine your future looking like. By starting to think about and save for your future now you are saving yourself a lot of stress in the future.

Online Resources

The Union Home Mortgage Foundation has partnered with BALANCE, a leading nonprofit specializing in financial literacy. By following this link (https://uhmfoundation.balancepro.org/) you can find so many resources to help you with your personal finances. They also offer different programs to help you learn about different aspects of saving and spending your money. You can work with BALANCE to develop a budgeting plan that works for you and your own needs. Their resources are helpful for any questions you may have while working on your financial well-being.

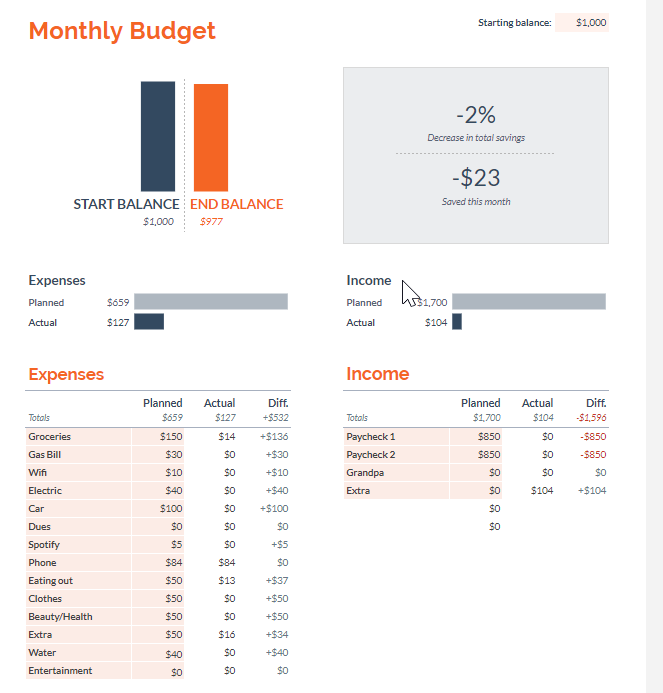

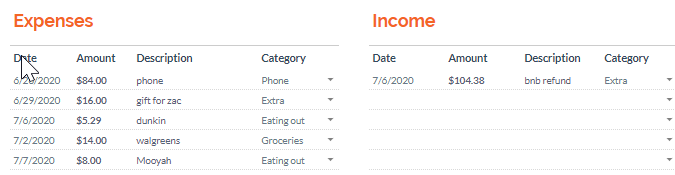

By doing some research online you will find there are many sites that have helpful resources for budgeting, that make it super easy during your busy schedule. Personally, I use a budget template on Google Drive that easily tells me how much I save each month and where I am not following my budget by spending too much. Below are examples of what my personal budget this month looks like! Whicheverbank you use probably has some resources for budgeting online through their apps or websites. Look around and find a system that works for you! Budgeting can seem like a daunting task but by figuring out simple tricks that work for you, you will be more financially prepared for your present as well as your future!